Claims that Medicare is issuing the flex card. The advert or caller promises the flex card is from Medicare or the CMS. Medicare doesn’t difficulty flex cards.

Your general public library or a neighborhood senior center could also have computer systems You should use — just Be sure to Sign off of one's account following using a general public Computer system.

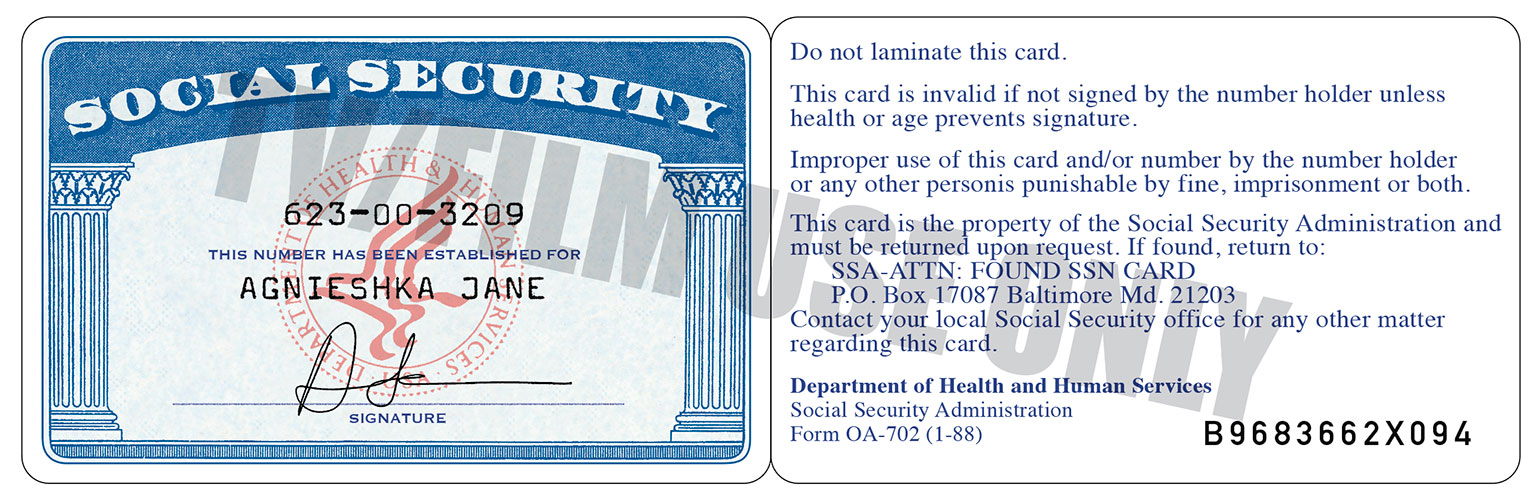

Learn the way the SSN validation is effective and how it's modified, and make a random SSN to see the validation in motion.

She proposed to call this week. But the opposite man from IRS 2 months in the past explained to me to resend the shape SS4.

Please Wait and see and don’t resend SS-four for the IRS. Doing this can develop confusion and delay the approval time.

Your banking account is at risk. The impersonator lets you know that because your Social Security number continues to be stolen, your financial institution accounts are in danger, Baker states.

Northwest will Enable you use their deal with in your Registered Agent handle, your LLC’s Place of work deal with, and also your EIN application so you're able to open up a U.S. bank account in your LLC. Any mail that is certainly sent for your LLC might be scanned by them and uploaded in your online account.

Do I must submit an application for an EIN for myself once more? Do I ought to make an application for her? If I was to open One more solitary-member LLC, do I continue to will need to apply for another EIN or can I use the one particular for all other LLCs shaped.

You are actually leaving AARP.org and likely to a web site that is not operated by AARP. Another privateness policy and terms of services more information about social-security-card-online-ssn will use.

A) While in the EIN variety, if I am going Using the default solution of getting my LLC taxed as being a partnership now, am I heading to have the ability to opt for taxation to be a C-Corp at a later stage?

The brand new SSN card style makes use of the two covert and overt security attributes made by the SSA and GPO layout teams.

In fact, it is possible to’t even apply for an ITIN unless you should file a U.S. tax return. Which means it’s not possible for getting an ITIN ahead of forming your LLC since the LLC would to start with have to exist and deliver money for any tax yr, then when April 15th check here real new social-security-card-online-ssn of the next 12 months comes all-around, you would probably post your U.S. tax return as well as your ITIN software.

The files offered as proof should be originals, or certified copies with the businesses that issued them. more information about social-security-card-online-ssn Photocopies or notarized copies usually are not approved. Social Security will return your files.

And perhaps When you have an ITIN, lots of foreigners get an mistake information (an IRS reference number) at the end of the online EIN application and end up being forced to use Form SS-4.